Recover Your Funds

Sign up for No Obligation Recovery consultation!

We Help Identify Reliable and Legit Investment Firms

Are you unsure about an investment platform? We can aid bring more clarity by detecting its legitimacy.

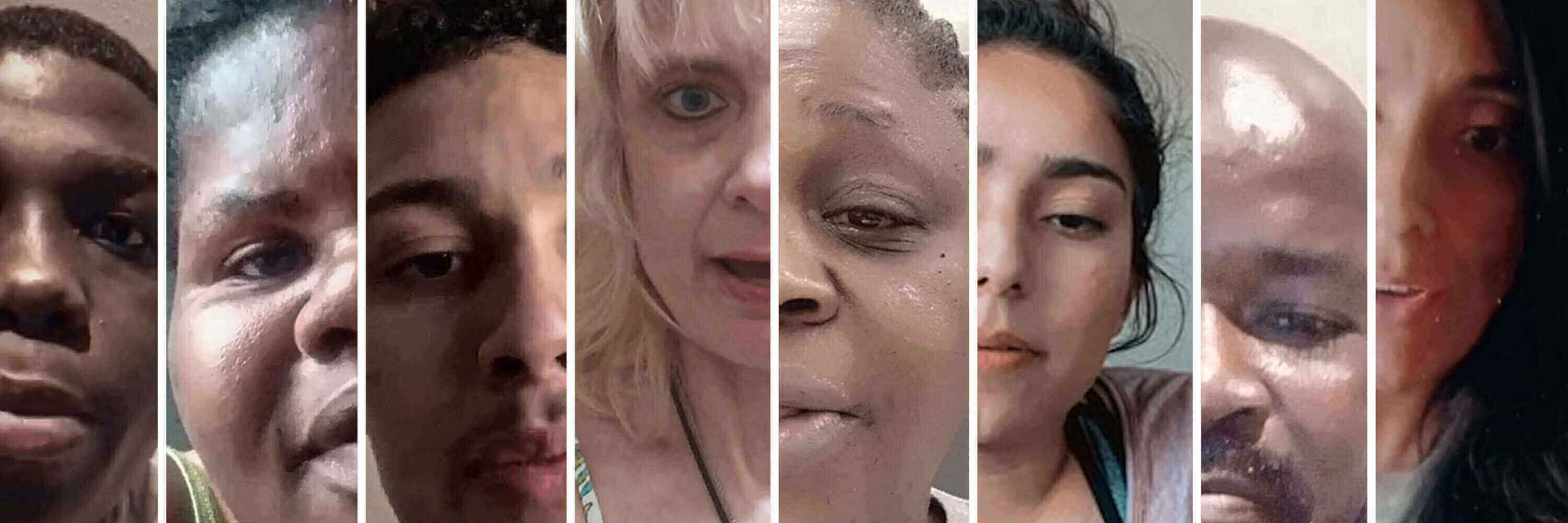

Testimonials

Listen to Financial Fund Recovery’s Success Stories

Recovery stories that speak all there is to know about Financial Fund Recovery.

You can be assured of smooth sailing when you have extra cash during an economic crisis. To better prepare for such a calamity, the majority of people invest in financial assets. Other reasons why investors choose to get involved in the market may vary from a destination wedding to retirement.

The financial market offers ample opportunity to make quick money in a relatively short period. Many have left their primary jobs and have become full-time investors and traders. Others invest as they get a tax break, so they end up saving.

As we are in the digital era, everything is at your fingertip and can be done instantaneously. Right from food and beverages to shopping, everything is done online. Even your banking transactions can be done online. With such facilities available, investing and trading online is hardly surprising.

However, with such technological advancements, scammers exploit innocent and naive people, making them victims of their elaborate and devious schemes. The targets are usually technologically inept seniors of our society.

With age, it is difficult for seniors to keep up with the current situation due to poor sight, loss of hearing, dementia, and many other physical ailments. They also fear depending upon others and thus wish to have substantial money in their piggy bank.

As per reports, most victims are above 60 years, and a third falls between the age bracket of 25 to 40. The rest are below 25 years. The investment reasons cited for the 25 to 40 years age bracket is that they have a good income and wish to look for a way to invest in protecting their future, while those below 25 years have less salary and want an alternate income source.

Everybody wishes to have a huge bank balance and wants to live a luxurious life. This greed is the most motivating factor for many who fall victim to elaborate scams. As times have progressed, these scams are getting more and more sophisticated. However, there are a few tell-tale signs that you, as an investor, can spot and use towards avoiding a scam.

The internet is exploding with several genuine investment firms, the rest being scams. In this article, we have listed a few pointers for you so that you can avoid becoming a victim.

Investment Website

When an investment firm approaches you, or when you are interested in them, it may be a good idea for you to visit their website. These websites act like an indicator, and you can be assured they aren’t lying.

Please go through the website and read all their content. Fortunately, most scammers do not have a good command of English. As a result, you can find repetitive grammatical errors. This should raise a red flag.

Registered and Regulated

Many investment firms are registered and regulated and will have their certificate on their home page. A certificate of registration and regulation assures that those investment firms are allowed to carry out financial services and will safeguard their clients' monetary interests.

The firm may be regulated through a government or a private institute. It is advisable to check if the investment firm has a valid license. Check out if these investment firms are blacklisted.

You can always verify the authenticity of the certificate by checking it online.

The location of the investment firm’s headquarters

Most scammers are located in a different country and they fictitiously mention that their headquarters are situated in a different country. At times these scammers might show that they’re located in some developed country with some random google location updated on their website. If you notice any address onto their website, double-check it through google maps and try to gain as much information as possible.

There are chances that a genuine investment firm may have its headquarters situated in a different country, so be thorough with your investigation. Besides, not all investment firms located overseas are fraudulent.

Review Section

When someone provides a service, the service isn’t like water that’ll quench everyone's thirst. There are some who would prefer cold water over warm and vice versa. Similarly, people have different preferences, experiences, and feedback when it comes to services. Hence, a firm cannot always have happy and loyal clients. At least some of them are bound to be angry clients.

However, going through their review section will give you a general idea of how well they conduct their business. If you see a majority of the reviews suggesting that they are a scam or revealing their scamming procedure then that may be a reason for you to be cautious.

Check for fraudulent activities

Run the name of the investment firm and add words like "Fraud" or "Scam" after it while searching online. Then, even if the firm is blacklisted or is under trial, the search results will show you everything that you need to know.

Offering Automated Financial Bots

Many investment firms boast of their financial bots, which they claim will multiply your wealth. It would be in your best interest to go for a reputed investment firm as they may have spent a lot of funds in creating a 'bot' that handles your financial wealth. These bots are field tested and are reliable. Contrastingly, fraudulent firms often employ automated trading bots even without running any tests, built in the most unreliable ways. Do some research before settling for one which tries to lure or pressurize you into making a decision.

Get Rich Quick

Nothing in this world is free; everything has a price tag attached. So if you see any investment firm boasting of making you rich quickly, they are probably lying. If the investment firm found the mantra to quick riches, why would they help others become rich? They would instead help themselves.

Competitive Pricing

Many scammers will offer services that will rival the best investment firms. Remember, it is worth going for a reputed investment firm rather than one offering their services at a lower price. In the long run, these reputed firms will ensure that your financial funds are secure and growing. It is a better pick over an investment firm that you know nothing about.

Client Service Center

If you are being contacted through an unsolicited call, look for finer details. If the person on the other end is a genuine investment salesperson, they will avoid using coercive tactics to convince you. Instead, they ensure that you get all the details and will certainly avoid words like "Once in a Lifetime Opportunity."

Investment firms are not like local Non-profit Governmental Organizations; they render their services to make money. So if the offer sounds extensively profitable, you should be alert.

A genuine salesperson won't be in a hurry to close the deal. Instead, they will allow you the time to understand and make a decision that is in your interest.

If you are required to fill up a form, examine their terms and conditions before filling out the form.

Senior Citizens

If you are in contact with any Seniors, be it your family or close friends, alert them with the latest scams prevalent in our society. Also, request them to seek your advice before they make any financial commitments with an investment firm.

Conclusion:

Making easy money is quite possible in today's world as everything is available at the click of a button. But navigating through the waters filled with Scammer-like sharks is pretty challenging. So ensure you do thorough research before signing up for any investment firm's services.

If you are confused or overwhelmed with information, the best course of action is to seek advice from your near and dear ones. But, of course, you can always go to your accountant or lawyer to seek professional advice.

© 2023 Financial Fund Recovery. All rights reserved.

Our website uses cookies to assure you have the best experience with us and further assist us in advertising our services. Please read our updated privacy policy to learn more.